Microfinance is a financial service which provides small loans to poor and low-income households and enables them to come out of poverty, increase their income levels and improve overall living standards. Micro Finance initiatives originated in Bangladesh and have now spread into all the third-world countries. India has adopted Micro Finance in its own unique ways and we are seeing serious benefits to the bottom of the pyramid.

Evolution of Micro Finance: The Grameen bank of Bangladesh

The genesis of microfinance can be traced back to the Bangladesh famine of 1974. Muhammad Yunus, then a professor at the University of Chittagong visited Jobra. There, he found basket weavers being exploited by money lenders on raw material purchases. Yunus decided to lend US$ 27 out of his pocket to a group of 42 weaver families to support their businesses. Observing the positive impact of his support, Yunus developed guidelines for the Grameen Bank. In 1983, the Grameen Bank project was established as an independent bank under the Grameen Bank Ordinance 1983. This is the beginning of Micro Finance formally.

The basic principles of Micro Finance were small sized loans, no physical collateral with emphasis on social collateral or peer monitoring and focus on women borrowers. Grameen Bank mainly served women as it discovered that women usually repay loans on time, invest their money for productive purposes and made expenditures to improve the quality of life of family members.

Under the model of micro finance promoted by the Grameen Bank, women borrowers were organized into SelfHelp Groups (SHGs), which would be entitled to borrow from the lending institution either for their individual or group requirements. Such groups were normally created by women from similar socio-economic backgrounds that strengthened the solidarity among these women.

The biggest impact of Grameen Bank’s early success was convincing the banks and other lending institutions that the poor are bankable. This is what led to the growth of Micro Finance.

Evolution of Micro Finance in India

In India, the formal banking network could not reach most of the underprivileged population. An action research programme was launched to identify the reasons for this inequality. Based on the findings of the Action Research Programme, a pilot project for linking 500 SHGs with banks was launched by the National Bank for Agricultural & Rural Development (NABARD) in 1992. The pilot project surpassed its target of 500 SHGs and 620 SHGs were credit linked by banks with total loan amount of INR 65 lakh as on 1994. This marked the inception of micro finance in India. This programme was called as the SHG Bank Linkage Programme and its successful implementation led

to the following three radical innovations by RBI and NABARD.

- Acceptance of SHGs as clients of banks – both for savings and credit linkage.

- Introduction of collateral-free lending.

- Permission to lend to SHGs without specification of purpose/activity/project.

The SHG movement, now in its 30th year, has emerged as a powerful intervention to cover the small and marginalized sections of the society. As of March 2022, the movement covers ~14 crore families through 119 lakh SHGs with savings deposits of over INR 47,000 crore and collateral-free loan outstanding of over INR 1,50,000 crores. And 87% of SHGs are led by women.

Table 1: Progress under SHG-Bank Linkage Programme (2019-20 to 2021-22)

| Particulars | 2019-20 | 2020-21 | 2021-22 | |||

|---|---|---|---|---|---|---|

| No. of SHGs (No. Lakh) | Amount (INR Crore) | No. of SHGs (No. Lakh) | Amount (INR Crore) | No. of SHGs (No. Lakh | Amount (INR Crore) | |

| SHG savings with Banks as on 31st March | 102 | 26,152 | 112 | 37,478 | 119 | 47,240 |

| Loans disbursed to SHGs during the year | 31 | 77,659 | 29 | 58,071 | 34 | 99,729 |

| Loans outstanding against SHGs as on 31st March | 57 | 1,08,075 | 58 | 1,03,290 | 67 | 1,51,051 |

Source: https://www.nabard.org/auth/writereaddata/tender/somfi-2021-22.pdf

Micro Finance in India and Bangladesh; a comparison

With the implementation of micro finance, both the nations primarily focused on poverty alleviation and improving the living standards of the poor. Bangladesh started the concept and India adopted it as an inspiration rather than an

imitation.

Indian version of Micro Finance differed from Bangladesh model in mainly two respects. First, India involved its Public Sector bank network to provide micro finance and created a link between SHGs, NGOs and Banks. Secondly, ‘thrift first and not credit first’ was the basis for Micro Finance in India. SHGs in India were encouraged to save and managing their own finances, give loans internally and to deposit savings with a bank, thus providing them access to the banking network and finally, negotiate with banks for credit.

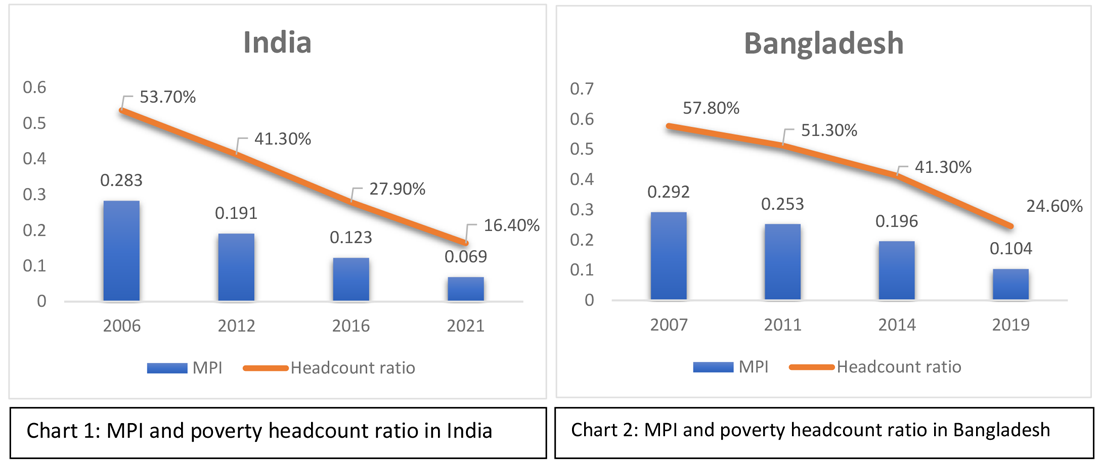

However, both the models had a positive impact on reducing poverty. The Multidimensional poverty Index (MPI) published by Oxford Poverty and Human Development Initiative (OPHI) and United Nations Development Programme (UNDP) suggest that there has been a steady decline in the poverty over the last 15 years.

Source: Multidimensional poverty Index (MPI) published by Oxford Poverty and Human Development Initiative (OPHI) and United Nations Development Programme (UNDP)

Source: Multidimensional poverty Index (MPI) published by Oxford Poverty and Human Development Initiative (OPHI) and United Nations Development Programme (UNDP)

Further India has come a long way in promoting Micro Finance. Since 2006, India has witnessed a steeper reduction as compared to Bangladesh in the multidimensional poverty index as well as the poverty headcount ratio. However, the absolute number of people below poverty line is much higher in India as compared to Bangladesh; owing to the larger population base.

Way Ahead

Despite the fact that microfinance in India has seen a significant expansion, there are areas where we can learn from Bangladesh and other nations. Aside from loans, microfinance institutions can focus on growing the number of savings accounts, as Kenya and Nepal have done, by offering incentives such as free bank account opening and no minimum balance. Increased savings can protect people against a disaster and help greatly towards financial inclusion. Furthermore, institutions can provide insurance to farmers to safeguard them from unanticipated shocks and stimulate the development of high-risk, high-return cash crops.

Such innovations in the microfinance industry can help to strengthen collaboration between microfinance institutions and the education, healthcare, water, and sanitation sectors. This can result in gaining people’s trust while strongly discouraging defaults and increasing profits, which might also have a positive domino effect of bringing in more players in the microfinance arena.