Since the late 1970s and 1980s, the bond and options markets were dominated by traders who learned their craft through experience. They believed that experience and intuition gave the edge to make money. By the mid-1990s, the old-school grizzled traders had been replaced by a new breed of quantitative analysts, applying mathematics to the “art” of trading.

Similarly, for decades the highest level of poker was dominated by players who had learned the game by playing it, “road gamblers” who had cultivated intuition for the game and were adept at reading other players’ hands from betting patterns and physical tells. Over the last few years, a new breed of players has risen to prominence within the poker community, applying computer science and mathematical tools to poker. These players have challenged many assumptions that underlie traditional approaches to the game.

Dealing with ambiguity through probabilistic thinking:

Poker teaches you to take risks and make decisions in ambiguity. It is like the cycle of a start-up condensed into two minutes. Starting a hand is like starting a company with an idea. You have no idea whether it is good or bad because you have no context of knowing what else is out there. You take a bunch of risks, you expense a bunch of capital, and sometimes you win, and sometimes you don’t. Sometimes despite the right decision, you lose and sometimes, despite the wrong decision, you win. Most often than not, you win for the correct decisions. Hence, probabilistic thinking plays a vital role in decision-making.

Being patient:

As a professional poker player, one folds over 80% of the hands. In the world of intense FOMO, it is important to be selective about investing ideas. Not every idea is worth backing, and one can’t capture all the different ways of making money in the market, so it is essential to be patient and wait for the right moment and bet big when one has the odds.

“Fold and live to fold again” – Stu Ungar (Greatest poker player of all time)

“The stock market is a no-called strike game. You don’t have to swing at everything. You can wait for your pitch”- Warren Buffet (Greatest investor of all time)

Playing the long game:

Another essential skill in investing and poker is looking only at long-term performance and ignoring short-term results. A poker player should not be ecstatic or disappointed with the results of one hand or a few sessions. In the short run, the role of luck is magnified, while over time, the skills will matter more. The same is the case with investing; an investor cannot be said to be successful or unsuccessful based on a few good or bad years. It is the consistent long-term performance that will matter.

Being objective:

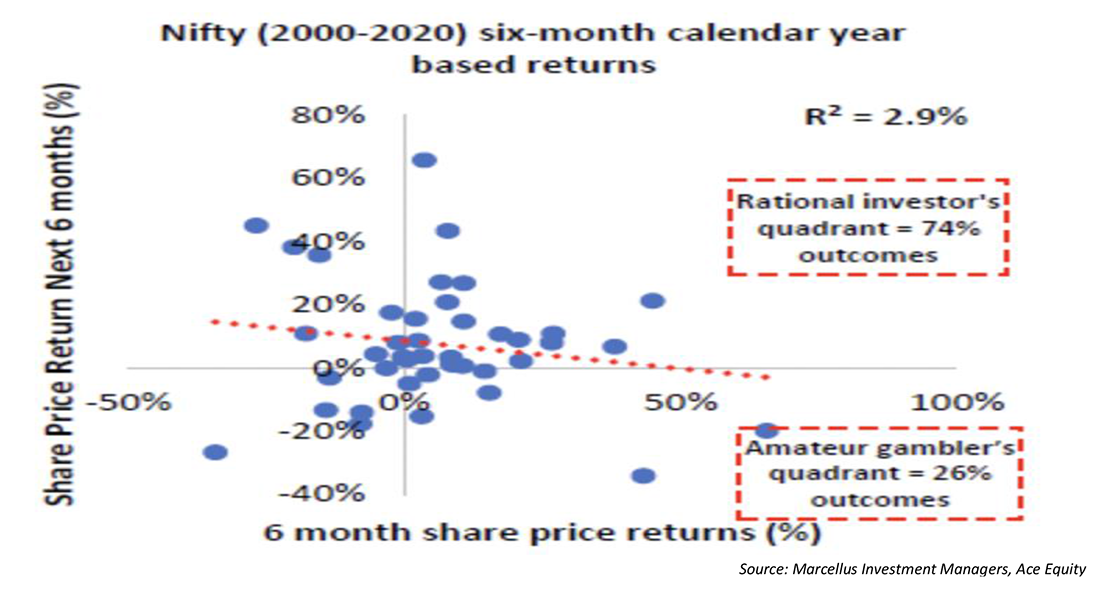

Many investors believe that if the markets have gone up in the past few months, then there is a high probability that markets will deliver negative returns in the coming months. But this is a fallacy known as Gambler’s/Monte Carlo fallacy, where we erroneously believe that a random event is less or more likely to occur based on previous events. As illustrated below, there is no significant correlation between returns from one six-month period to the next six-month period. Thus, suggesting that these events are independent and making decisions based on past results is a fallacy.

Graph above shows Returns delivered by the Nifty50 index in 6 months regressed with returns delivered in the previous months. Coefficient of Determination(R2) = 2.9%, which suggests that the previous 6 months’ returns explain only 2.9% of the variation in 6 months’ returns.

We live in a country that measures success through numbers like Board marks, JEE rank, CAT percentile, CTC etc. So, it is challenging to go against societal norms and pursue a career as a professional poker player. It is never an easy decision, as there are far too many people who do not see it as a career option and only think of it as gambling. One can win in the long run only by consistently making mathematically superior decisions, thus mitigating the aspect of luck. To succeed in poker or investing, one must have the ability to go against the common wisdom and think differently and independently.

Long-term thinking, making decisions in ambiguity, patience, and courage are common traits in investing and poker. Poker is a zero-sum game played by individuals who make money off each other. Whereas investing can be a positive sum game, one can add real value to the economy by matching the capital seekers to investors and making the capital allocation process more efficient.

This article was originally published in Financialexpress

Link to the article: https://www.financialexpress.com/market/poker-and-investing/2987998/