News of 23 Indian Government Bonds worth US$ 330 billion approximately getting included in the JP Morgan Emerging Market Bond Index with a 10% weightage opens the door for foreign investment in the Indian debt market.

India is expected to become the third largest economy by 2030, surpassing Japan and Germany. It is spending massively on infrastructure development to achieve this target. In the budget for the fiscal year 2023-24, the allocation for capital investment in infrastructure is set to rise by 33%, reaching Rs. 10 lakh crore (US$ 122 billion), equivalent to 3.3% of the GDP1. Foreign investments will play a key role in making this target sustainable.

A Look Back

India started to make efforts to be included in the global bond indices in 2013 in response to the economic turbulence caused by the announcement of the possibility of quantitative easing by the U.S. Federal Reserve. The ‘taper tantrum’ episode had resulted in large withdrawal of foreign investments from the country, depreciating the Indian Rupee. To control the volatile situation, one of the measures adopted by the RBI was to increase interest rates to encourage foreign investments, resulting in high borrowing cost.

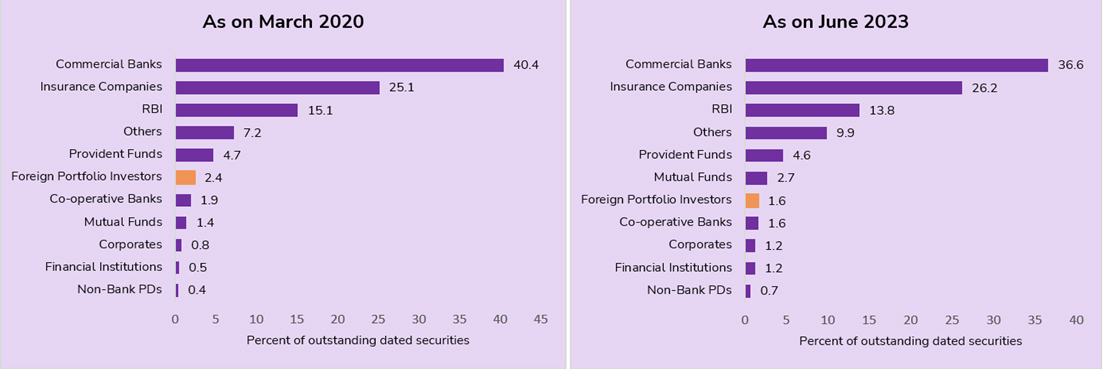

However, until 2020, the Indian Government bond market was dominated by domestic investors (Figure 1). This was primarily due to government-imposed restrictions on the extent of foreign ownership allowed for its domestic debt. Specifically, the government had enforced a 6% cap on foreign ownership of outstanding government securities, along with a limitation restricting total foreign investment in any security to 30% of the outstanding amount2. This provided little incentive to foreign investors to include Indian Government bonds in their portfolio. Moreover, foreign investors were unable to monitor the performance of Indian G-Secs because they were not included in any indices. This was a result of India’s inability to meet the stringent criteria set by global bond indices such as the JP Morgan Emerging Markets (EM) Bond Index.

Figure 1: Ownership Pattern of Government of India Dated Securities

Source: Public Debt Management Quarterly Report, Jan-Mar 2022 & Apr-Jun 2023 (Department of Economic Affairs)

Hence, in 2020, when government expenditure soared due to the pandemic and the Indian Government sought ways to source funds and reduce its cost of borrowing, RBI introduced a separate channel, Fully Accessible Route (FAR). FAR made foreign investment in specific bonds possible without any regulatory restrictions. At present, there are 31 securities worth US$ 400 billion that can be traded under FAR.

Current Scenario

The Government of India’s persistent efforts to secure a place in the JP Morgan Emerging Markets Bond Index yielded positive results, with the index providers officially declaring India’s inclusion effective from 28 June, 2024. This inclusion will be phased gradually over a span of 10 months, with an approximate monthly weightage of 1%, culminating in a maximum weightage of 10%. The inclusion reinforces India’s stable economic conditions, also reflected in its consistent BBB-/Baa3 sovereign credit rating by Fitch and Moody’s. “According to the JP Morgan team, almost three-quarters of benchmark investors surveyed were in favour of India’s addition to the index3”.

Upcoming Trajectory

Higher Capital Inflows

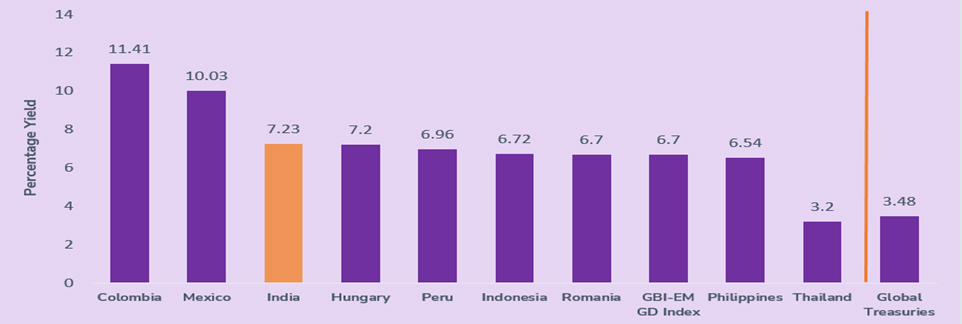

The initial expected capital inflow of US$20-30 billion is just the beginning. India’s relatively higher yields compared to other emerging markets in the index could make it an attractive choice for managers seeking to overweight their portfolios (Figure 2). Moreover, JP Morgan’s inclusion has the potential to set a precedent for other emerging market indices, such as the Bloomberg-Barclays Local Currency Government Index and the FTSE Government Bond Index, which could lead to a further increase in portfolio inflows.

Figure 2: Average Yields of BBB+/BBB/BBB- Rated Large EM Markets

Source: Srinivasan, M., & Furey, D. (2023). India Sovereign Bonds: Announcement of Index Inclusion. White Paper, State Street Global Advisors

Stronger Rupee

Higher capital inflows potentially lead to greater demand for the Indian rupee as investors need to convert their foreign currencies into rupees to purchase these bonds. Increased demand for the rupee typically leads to its appreciation. A stronger rupee can also result from improved trade balances. The additional capital can be used to finance trade and current account deficits, reducing the need for rupee depreciation to maintain competitiveness.

A stronger rupee may lead to reduced intervention by India’s central bank to support the currency. When the central bank doesn’t need to continually sell rupees to stabilize its value, it can reduce currency supply, contributing to appreciation. A stronger currency can have positive effects on India’s economic indicators. It can lead to lower inflationary pressures by making imports cheaper, which, in turn, can encourage the central bank to adopt more accommodative monetary policies.

Lower Yields

According to an article by the Bank of Baroda4, securities in 5-10 year range are poised to experience the most significant benefits. This is due to the fact that, as of 25 September, 2023, this particular range within the FAR holdings represents the largest share. Consequently, we may observe a downward shift in the entire yield curve within this segment.

Reduced Pressure on Commercial Banks

India’s inclusion in the global bond index is expected to alleviate the burden on commercial banks, which have historically shouldered the majority of government bonds (Figure 1). As foreign investors gain easier access to India’s government bonds, there will likely be a more diversified investor base. This diversification could reduce pressure on domestic banks to absorb government debt, offering them greater flexibility in managing their portfolios and freeing up capital for other lending activities.

Increased Volatility

India’s bond market will become more closely tied to global market sentiment. Any adverse global developments, such as changes in U.S. Federal Reserve policies or geopolitical events, can lead to sudden shifts in investor sentiment, affecting bond prices and yields. Sudden shifts in investor sentiment or changes in global economic conditions can lead to abrupt inflows or outflows of capital, contributing to market volatility. A surge in foreign investment can lead to rupee appreciation, while sudden outflows can result in depreciation. These currency fluctuations can affect the competitiveness of Indian exports and may require intervention from the central bank to stabilize the currency.

Conclusion

India’s inclusion in JP Morgan Emerging Market Bond Index is a positive development and an attestation to India’s stable economic growth. The potential benefits of the inclusion can have a long term impact on the Indian economy. However, the RBI and the government will need to closely monitor market conditions and be prepared to implement measures to ensure stability.

Source:

1. IBEF (May 2023). Advantage India

2. Srinivasan, M., & Furey, D. (2023). India Sovereign Bonds: Announcement of Index Inclusion. White Paper, State Street Global Advisors

3. The Washington Post

4. Mazumdar, D & Gupta, A. (26 September 2023). Impact of India’s inclusion in JP Morgan bond index