Blockchain has been a buzzword for the last five years. Google trends shows that the word showed the most interest in December 2017 and has been in talks pretty much since then. But is it here to stay? Is it something that the banks need to worry about? Will it eliminate banks in the coming future?

“Banks are not going to go away, but they would be forced to adopt blockchain technology. Banks and the centralized finance bodies would face immense competition by the decentralized finance space, popularly known as Defi, in the next 15-20 years”, says Neil Martis, founder of Zupple Labs, the parent company of LegitDoc which issues blockchain-powered certificates and has been implemented by the Government of many states in India.

The future and impact of blockchain technology can be seen in three ways. These are either to compete, co-opt or adopt the technology. Let’s take the analogy of what happened to print media with the advent of the internet. Initially, media houses feared that people would migrate to digital forms of sharing, and quite a few of them thus transformed their businesses to have a digital presence. A few could not, which resulted in the withering of their businesses, and many eventually died. It also created space for peer-to-peer media sharing, with platforms such as Twitter, Meta, and many others giving tough competition to popular media houses. Though, it doesn’t mean that the media houses have become dormant. People still rely on media houses for authentic information. Drawing a parallel to this, we can expect a similar response in the finance world with the emerging Blockchain and Web3 technology. Major global banks such as JP Morgan, Goldman Sachs, and HSBC have invested a huge amount and adopted technology in many functionalities of their operations.

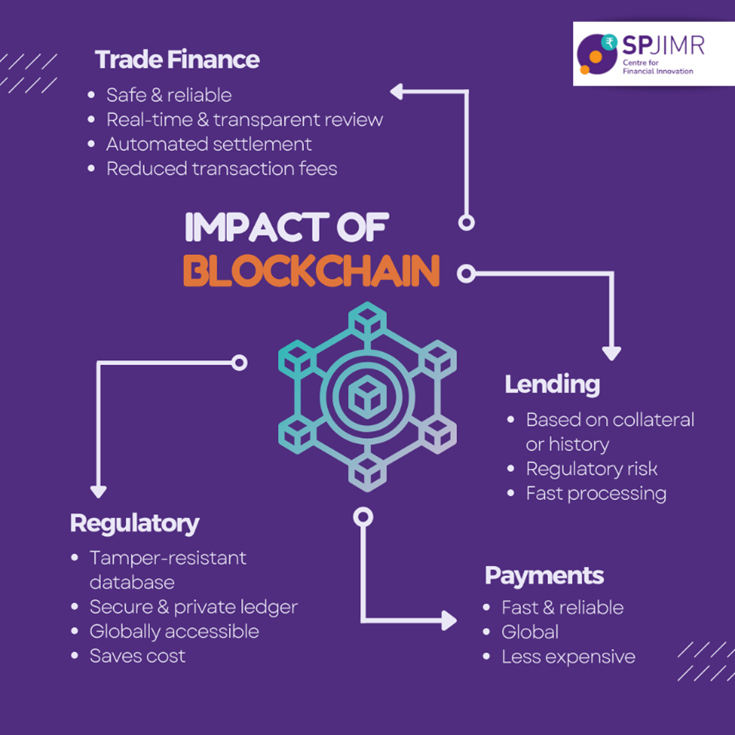

Dissecting the functionalities of a bank leads to lending, payments and remittances, trade finance, regulatory, compliance, insurance, fundraising, etc.

Source: Author’s Contributions

Lending

If we peek into the lending space, presently, banks do a great job in regulatory terms; however, they take a long time, typically in the range of a couple of months, to process the loan and provide cash to the borrower. As the lending in banks is monitored by the central banks of the country, there are fewer chances of default, and legal proceedings can be taken forward if the borrower ends up not paying the EMI for three consecutive periods, which establishes trust in the banking system. Whereas blockchain-based P2P applications have smart contracts in place, to manage the collateral and hence allow lending to the borrowers without the intervention of any governing or regulatory bodies. It allows the process to be far quicker than the traditional banking process. There are a few blockchain-based projects that allow unsecured lending based on the past activity of the borrower, i.e., credit history, loan amount, the risk involved, loan conditions, on-chain, and off-chain credit data, etc.1

It will take a good amount of time, though, to have a strong unsecured lending market on the technology until a user profile of all the stakeholders gets established on the blockchain. Right, there are a few projects like “R3 Corda” that are not based on a public distributed ledger technology but instead are based on a private distrusted ledger technology and allows regulatory and legal bodies to come into the picture, making them more trustworthy than purely smart contract-based systems. Now, to compete with the technology, banks need to come up with a far more efficient system to process loans, there have been developments in the recent past, but there is a long way to go. The example of R3 Corda, on the other hand, is the adoption of blockchain technology, and HSBC is one of the banks to adopt the project by R3.2 There are already a good number of blockchain-based projects competing in this space. The top ones are Binance, BlockFi, SpectroCoin, Cake Defi3 , AAVE, CoinRabbit, Nexo4 , Nebeus, etc.

Remittances and Payments

Coming to the remittances and payments aspect, India, by far, has been doing a particularly great job of implementing one of the most exemplary payment systems across the nation. Unified Payments Interface (UPI) works on top of IMPS and had the highest single-month transactions in May 2022.5 The system is real-time, free of cost, and reliable, though there is an anticipation of the application of an insignificant transaction fee to fund the technologies in place for the payments system. While national payment systems have come a long way, international payments still struggle because of the existence of well-established “rails”. There are different rails in place: Visa, Paypal, ACH, SWIFT, etc.6 These rails work primarily on the same back-end technology, take around 2-3 days to complete the transaction, and charge a transaction fee in the range of 2-5%.7 Blockchain technology, on the other hand, provides a seamless transaction experience and processes the transactions, giving a close to real-time experience while charging pennies compared to conventional payment methods. In the payments sector, Mastercard and Samsung have come up with a blockchain technology system and are ready to compete with other decentralized payments projects like Metamask, Cardano, Hyperledger, RippleNet, etc.

Regulatory and Decentralized Exchanges

Blockchain can also address the regulatory and compliance aspects of the banking system. Blockchain provides a tamper-resistant database that, when fed with user data, can serve the purpose very well. It offers a secure and private ledger to store and share the data privately with the stakeholders involved; hence, it can be used to validate the information.8 Elliptic is trusted for regulatory and compliance on many of the exchanges, including Coinbase. A marketplace for cryptocurrencies has found space in the decentralized network as well, and many exchanges have come up with solutions for the same. A few of them are UniSwap, PancakeSwap, dYdX, KineProtocol, SushiSwap, etc.

Trade Finance

Inspecting the landscape of trade finance, blockchain technology has brought disruption to the space with projects like “We.Trade” and “Wave”. Wave, in association with Barclays, claims to be the first project to execute a global trade transaction using blockchain technology.9 We.Trade is another project that is backed by IBM and an association of 12 European banks, including Societe Generale, UBS, HSBC, Deutsche Bank, etc.10 This joint venture enables a safe and reliable platform for buyers and sellers to trade using smart contracts and distributed ledger technology. The implementation of blockchain technology, which brings real-time review, transparent reviewing, automated settlement, and decreased transaction fees, addresses the issues of manual contract creation, delayed payments, and manual AML reviews.11 Though these projects are doing phenomenally well, there is a lack of trust somewhere, and the projects struggle to get funding in many cases, as did We.Trade, which was on the verge of liquidation when IBM jumped in at the eleventh hour and injected funds to keep it going.

It would be unfair to conclude without mentioning the use of blockchains as a store of value, which is why the technology came to life after a decade. Blockchain-based stablecoins are a go-to solution for depreciating currencies, especially in countries that suffer from hyperinflation, such as Argentina, Venezuela, South Sudan, and Zimbabwe, among others. Bitcoin and Ethereum have gotten the most traction among investors while considering blockchain-based decentralized tokens as a store of value, with Elon Musk being one of the flag bearers. Applications such as ChainLink12 are disrupting the financial services space as well by providing on-chain as well as off-chain data using smart contracts.

In conclusion, it would be practically impossible for traditional banks to compete with companies based on blockchain technology without improving the incumbent system to a great extent, which doesn’t seem quite achievable. And a good number of traditional banks have already adopted and invested to embrace the disruptive technology. Companies like MasterCard13 and Barclays14 have dedicated Accelerator programs to collaborate with startups in the blockchain ecosystem. These projects need time to be refined and put to use on a large scale, but discarding the technology is surely not the way forward. It might not solve all the problems in the world, but it is surely going to make a deep impact on the financial system around the world.