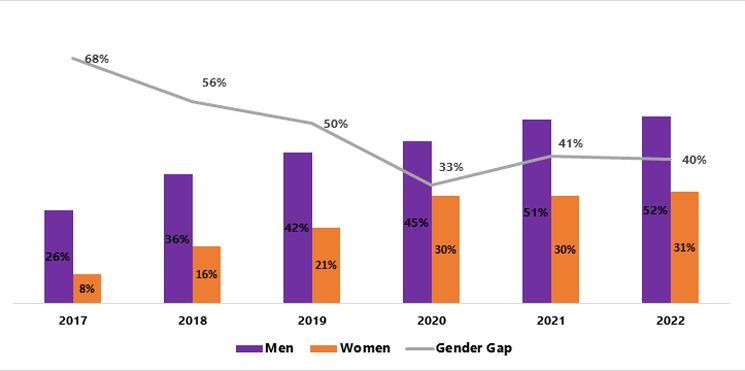

In the digital era, where financial services are at our fingertips, women in India encounter substantial hurdles in embracing this tech wave. In 2022, 81% of Indian men and 72% of Indian women owned mobile phones, revealing a 11% gender gap. Further, this divide is accentuated, with 52% of men and 31% of women using mobile internet, resulting in a notable 40% gender gap in effective mobile internet utilization1 . Barriers include a lack of basic literacy, a lack of knowledge about the mobile internet, and societal norms limiting phone access. As of 2023, India continues to face a lingering financial gender gap2 . However, the rapidly growing fintech sector provides an opportunity to enhance women’s financial inclusion.

The Reserve Bank of India’s Financial Inclusion Index has shown a noteworthy 16% increase from 2017 to 20233. This growth is attributed to the increased accessibility of financial services. Fintech firms are leading the way in driving transformative change through innovations like digital wallets, mobile money, peer-to-peer lending, and inventive micro-insurance products.

Gender Disparities in Fintech Usage: Insights from Global Research

The research paper titled The Fintech Gender Gap published in the Journal of Financial Intermediation in 20234 explores gender disparities in fintech usage based on user attitudes. The study utilized the 2019 EY Global Fintech Adoption Index, surveying 27,103 adults across 28 countries, with 50% female representation and an average age of 43 years. The data indicate that women, often have lower incomes than men. They are less likely to live alone, work, or hold higher education degrees. Women also exhibit greater uncertainty about future planning.

Key insights of the study:

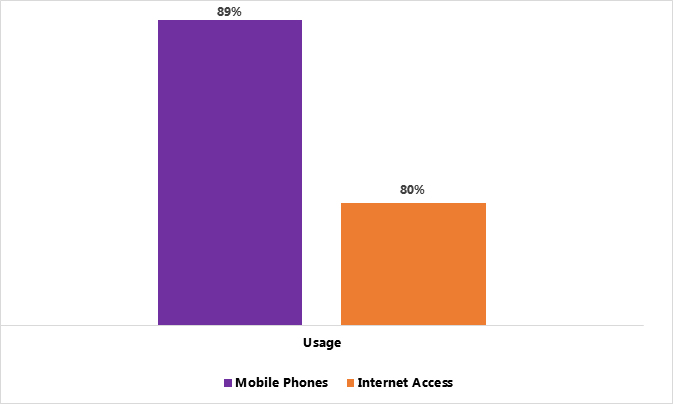

1. Digital Usage in Developing Countries: In developing countries, the usage of mobile phones and internet access among individuals was found to be 89% and 80% respectively (Figure 1). The proportion of men using mobile phones is 2% higher than that of women. This difference is much smaller than the global gap of 6%.

Figure 1: Digital disparity in developing countries

Source: Chen, S. & Doerr, S. & Frost, J. & Gambacorta, L. & Shin, H.S., 2023. “The fintech gender gap,” Journal of Financial Intermediation, Elsevier, vol. 54(C).

2. Fintech Adoption Disparity: While fintech holds promise to narrow financial service gender gaps, the study reveals that men’s fintech adoption rate is 29%, surpassing women’s at 21%.

3. Drivers of Fintech Gender Gap: It includes attitudes towards technology especially concern for privacy and security, price sensitivity, and product suitability. These factors explain 75% of the gender gap in fintech usage (Figure 2).

Figure 2: Factors influencing the gender gap in fintech adoption

Source: Chen, S. & Doerr, S. & Frost, J. & Gambacorta, L. & Shin, H.S., 2023. “The fintech gender gap,” Journal of Financial Intermediation, Elsevier, vol. 54(C).

4. Financial Gender Dynamic: Men use traditional banks (7.1%) and fintech (5.2%) more than women. Integrating fintech with traditional services reduces the gender gap. The gender gap was approximately 50% smaller when fintech complements traditional financial services. This indicates that women are more receptive to fintech when it complements rather than substitutes traditional financial services.

Thus globally, men use fintech more than women. The study suggests that policymakers tackle underlying issues for greater inclusivity in fintech services.

Implication in the Indian Context

India made notable strides in narrowing the gender gap in mobile internet adoption between 2018 and 2020. Unfortunately, a recent surge in mobile internet adoption among men has reversed this progress, emphasizing the need for sustained efforts to promote financial inclusion (Figure 3)5 .

Figure 3: Mobile internet adoption in India, 2017-2022

Source: GSMA Consumer Survey, 2017-2022

To bridge the digital gender gap by 2030, over 800 million women must embrace the mobile internet, but based on prevailing patterns, the expected mobile broadband adoption is forecasted to be limited to 360 million.6

Fintech Bridges the Gender Gap in India

Empowering Financial Inclusion: The initiative of Pradhan Mantri Jan Dhan Yojana (PMJDY) is effectively narrowing the gender gap. India ranks 135th out of 146 countries, with a gender gap closure of only 62.9%. The LXME fintech company aims to address the market gap created by gender disparity to capitalize on the opportunity through its unique Neo Banking Platform. It intends to have a lasting impact on how Indian women manage finances7.

BNPL (Buy Now, Pay Later) Revolution: Additionally, the rise of BNPL solutions contributes significantly to financial inclusion, offering women easier access to credit. Fintech’s influence democratizes credit, with 66% of women finding it accessible and 51% expressing a preference for BNPL over credit cards8.

Tailored-made products by fintech: Fintech firms in India are adapting by developing tailored products to meet women’s specific needs. For example, Dvara SmartGold offers doorstep services for assaying gold for loans, empowering women to gain control of their finances9. Another key strategy involves empowering women through financial literacy programs. Initiatives such as the Saksham mobile app, by the National Bank for Agriculture and Rural Development, educate rural customers, including women on various financial topics available in multiple Indian languages. This app can be used both in online and offline mode.

Enhanced financial reach: Fintech firms leverage technology to extend financial access to underserved populations, including women. Platforms like Grameen Financial Services, aided by digital wallets like Phonepe and Paytm, enable secure cashless transactions and provide essential services to women. PayNearby has also launched a ‘zero investment plan’ for women entrepreneurs, empowering them across various PIN codes9.

Conclusion

Fintech companies are proactively utilizing technology to overcome barriers, enhancing the accessibility and user-friendliness of financial services for women. Strategies include tailored products, government initiatives, financial literacy programs, improved access, and a customer-centric approach. Ongoing efforts to address discrimination and societal norms are the key to significant progress. By steadfastly implementing these strategies, fintech can play a transformative role in diminishing gender disparities and fostering a more inclusive financial environment in India.

Sources:

1. https://www.boomlive.in/explainers/only-31-of-women-in-india-use-mobile-internet-says-gsma-report-22198

2. https://bfsi.economictimes.indiatimes.com/news/fintech/breaking-barriers-fintechs-role-in-achieving-gender-equality/98418216

3. https://www.statista.com/statistics/1421253/india-financial-inclusion-index/

4. Chen, S. & Doerr, S. & Frost, J. & Gambacorta, L. & Shin, H.S., 2023. “The fintech gender gap,” Journal of Financial Intermediation, Elsevier, vol. 54(C).

5. GSMA Mobile Gender Gap Report 2023

6. https://telecom.economictimes.indiatimes.com/news/industry/india-largely-drives-gender-gap-in-mobile-internet-use-across-south-asia-lmics-gsma/100652947

7. bfsi.eletsonline.com

8. https://business.outlookindia.com/news/technology-bridging-the-gender-gap-in-financial-inclusion-news-185862

9. https://blogs.adb.org/blog/how-fintech-can-enable-financial-inclusion-and-reduce-gender-gaps-india