The Indian Banking, Financial Services and Insurance (BFSI) sector is undergoing an unprecedented digital transformation, resulting in enhanced system efficiency, greater financial inclusion, reduced costs, time-saving measures, and superior customer experiences. This digital revolution is driven by the fintech firms capitalizing on tech innovations to modernize financial service products and delivery methods. In 2022, the Indian fintech sector had the second highest funded start-ups, with a total funding of USD 5.65 billion. The fintech sector funding accounted for 14% of the global share, and the market opportunity is projected to be USD 2.1 trillion by 20301. India ranked 2nd in terms of deal volume globally 1. These developments in the BFSI sector challenge the traditional banking models, which are matured and stable, fostering greater competition in the market and prompting banks to leverage technology to enhance their operations2.

Banks can adopt innovations in the following ways:

a) Internal research and development of the products and services

b) Collaborations with the fintech companies for their specific product(s)

c) Investment or M&A with fintech companies

d) Multiple banks collaboration to develop a fintech solution

The research paper titled “How do banks invest in fintechs? Evidence from advanced economies”, published in 2022 in the Journal of International Financial Markets, Institutions and Money, studies banks’ response to the growing fintech competition by empirically analysing their investment strategy in fintech companies. The research paper uses a sample of 623 fintech companies from developed countries engaged in 803 investment rounds from 2008 to 2018. A total of 263 banks participated in the 803 investment rounds. The fintech companies were categorized into fin-native and tech-native. Fin-native companies’ businesses were based on open banking, deposit and lending, including real estate finance, investment management, capital raising (including crowdfunding), market provisioning (of new platforms for financial instruments that could not be traded before), digital wallets and payments and insurtech. Tech-native companies’ businesses were based on Blockchain, AI, big data and machine learning, cybersecurity and software & services.

One of the key findings of the paper is that out of the 803 rounds of investments, 52% were aimed at fin-native companies, of which 79% were made through equity and 21% through debt. The study also highlights the following factors impacting a bank’s decision to invest in a fintech company:

1) Deal Size: The deal size increases if more banks participate in the round. An additional bank can increase the amount raised between 3.5% and 7.6%.

2) Age of the fintech company: As the fintech companies mature, the rate at which they attract larger investments decreases.

3) Fintech company’s specialization: Banks tend to prefer investing in fin-native companies. However, as the company’s age increases, the likelihood of it being fin-native decreases.

4) Bank features: Larger Banks tend to invest more in fintech companies. Also, less efficient banks, i.e., banks with higher cost-to-income ratios, are more inclined to invest in the innovation of fin-native companies.

5) Equity Deals: A larger deal size reduces the probability of equity financing. An additional bank in the investors’ pool increases the probability of primarily equity-based funding. Larger banks are more likely to invest through equity rather than extending credit lines. Likelihood of equity financing reduces with the age of fintech. Harsher competition from unlicensed lenders in certain countries may push banks to pursue riskier strategies, including choosing equity investments. In contrast, in regulated environments, banks lean more towards credit.

Implications

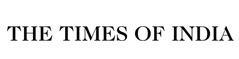

In the current ecosystem in India, fintech companies play more of a collaborative role with the banks2. The Indian start-up funding landscape is dominated by venture capitalists, angel investors and private equity investors. Banks are yet to emerge as key players. However, big banks like Axis Bank, HDFC Bank, ICICI Bank and State Bank of India are cautiously investing in fintech companies (Figure 1)3 . This is consistent with the results of the study that larger banks tend to invest more in fintech companies. However, the absence of public sector banks from Figure 1, other than State Bank of India, with a higher cost-to-income ratio, contradicts the conclusion that inefficient banks tend to invest more in fintech companies. India is expected to become the third-largest domestic banking sector by 20504 . In 2020,

“the Government of India merged ten public sector banks into four banks to drive credit growth, lift the slowing economy and boost the government’s target of a US $5-trillion economy by 2024”4. This consolidation has resulted in an approximately 10% reduction in the NPAs of the weaker banks5 . Driven by phenomenal demand and government policies, public sector banks are expected to perform better and become more competitive in the market.

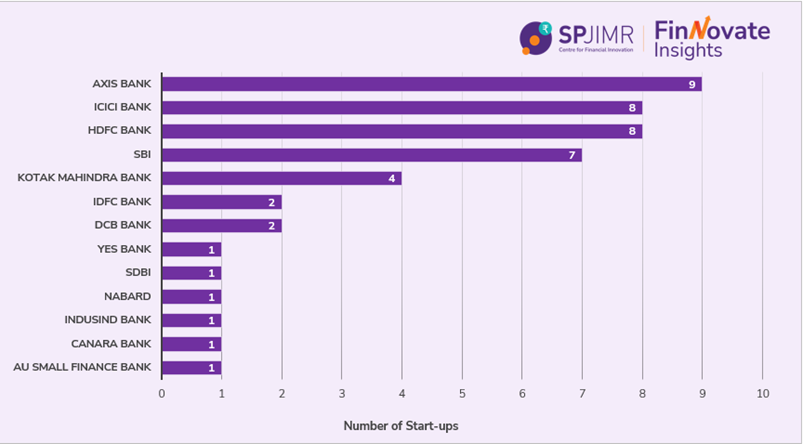

According to Tech Start-up Funding Report, Q1, 2023 by Inc42, debt financing was preferred over equity funding for late-stage deals in Q1 2023. The number of debt financing deals was 40% higher in Q1 2023 than in Q1 2022 (Figure 2). This data is again in line with the results of the above study that chances of equity financing reduce as the age of fintech rises.

Figure 1: Total number of start-ups invested in by the Indian Banks as of July 2023

Source: Author’s calculation derived from CB Insights, Expert Collection.

Figure 2: Number of late-stage investment deals in India from Q1 2020 – Q1 2023

Source: Inc42

Conclusion

In the current scenario, any collaboration between banks and fintech firms should not be a zero-sum game6 . With licenses from sectoral regulators and years of experience in regulated environments, banks and financial institutions in India have established significant expertise in regulation and compliance. Fintech companies deliver their financial services directly or indirectly by collaborating with these seasoned banks/financial institutions to tap into the formal financial market. Such collaborations can take various forms, including SaaS engagements, technology service provisions, or agency partnerships. Even when fintech firms compete head-on with the banks in the Business-to-Consumer (B2C) domain, the end product often comes from the banks, leading customers to maintain direct relationships with them2.

Source:

1. Invest India, National Investment Promotion and Facilitation Agency of India

2. Grant Thornton Bharat LLP (2023). BFSI-fintech Collaboration. An India Perspective

3. CB Insight lists 892 Indian fintech companies with investor information. Of these 892 companies, Figure 1 includes only those with investments received from Indian Banks.

4. Indian Brand Equity Foundation: Banking (May 2023)

5. The Economic Times (29 May 2023)

6. Murinde, V., et.al. (2022). The Impact of Fintech Revolution on the Future of Banking: Opportunities and Risks