In the short run India stood to benefit from the inclusion in the Index. However, whether India would have been able to sustain the momentum in the long run hinged on its economic performance.

Indian G-Sec were expected to be listed on the JP Morgan GBI-EM (Global Bond Index – Emerging Markets) by 2023. However, according to the latest news, index providers have decided not to include Indian Sovereign bonds in the Index and keep them under review. Concern over Indian market’s lack of adequate trading infrastructure has been cited as the reason behind the decision. Investors were looking forward to India’s inclusion in the Index. The Street view was that the anticipation of India to soon be included in the JP Morgan GBI-EM had put pressure on the yields. It’s a missed watershed moment for the Indian Debt Markets. So, let’s understand what this inclusion could have meant for Indian debt markets?

JP Morgan GBI-EM is one of the major indices for Emerging Markets’ Debt. The Economic Policy Division of the Ministry of External Affairs expected India’s inclusion in the Index would have led to higher capital inflows to the tune of US$ 40 billion initially. These inflows would have helped improve India’s rising balance of payment deficits and in strengthening the rupee.

Higher inflows could also have helped in keeping yields in check. A lower G-Sec yield would have reduced the Government’s cost of borrowing. According to the Union Budget 2022, the Government of India’s cost of debt was Rs. 808101.7 crores. (US$101.37 Billion), which is estimated to rise to Rs. 937437.4 crores (US$117.59 Billion). Further, the Government has an ambitious US$ 130 billion spend plan on infrastructure. So, it is imperative to bring down cost of borrowing.

Downstream effect

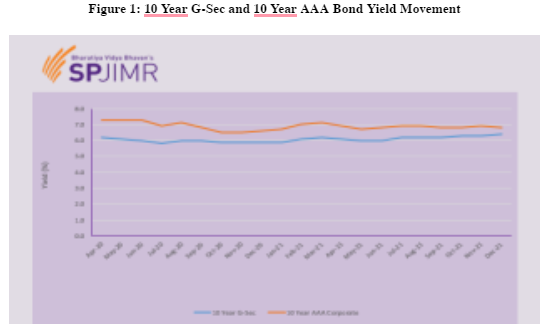

Lower G-Sec yields should have also pulled down the corporate bond yields. Corporate bonds typically trade at a premium to G-Sec across maturities (Figure 1). According to RBI, G-Sec curve provides a stable base for pricing of corporate bonds. So, if G-Sec yields reduce, then corporate bond yields should also reduce. And, this should have led to higher issuances and higher liquidity in the Corporate Debt Market.

*1 US$ = Rs. 79.7194. Exchange Rate as on end of August 2022. Source: RBI

Significance of listing

It is not easy to get listed on the GBI-EM Index. There are strict eligibility criteria related to maturity, liquidity, per capita Gross National Income, issue size etc.; that a country has to meet to get listed. Even after meeting these criteria, every country gets an assigned weightage on the Index. This weightage is based on the size of the country’s sovereign debt market. Indian G Sec is a US$ 1 Trillion Sovereign Bond Market. So, if India was included, India’s weightage on the Index was expected to be 10%, which is the maximum weight allocated to a country on the Index.

The weightage of a country in the Index has a significant role in determining the country’s capital inflows. According to an IMF study, a country’s weight in the Index guides the portfolio allocation of benchmark-driven investment across countries in the Index. The same study also concluded that during the COVID-19 pandemic, “portfolio outflows from local currency bond markets were strongly correlated to the weight of the country on the Index”.

However, the weightage of a country in the Index is readjusted based on the country’s performance, economic conditions, and other factors. Russia used to have a 10% weightage on the Index. Post the Ukraine crisis and sanctions, Russia has been removed from the Index. Russia’s exclusion had led to a stronger case for India’s inclusion; to fill the gap.

Further, inclusion in the GBI-EM Index would also have opened doors to inclusion in other Emerging Market indices; Bloomberg-Barclays Local Currency Government Index and FTSE Government Bond Index. All of these would have further enhanced portfolio inflows into Indian Debt Markets.

Hence, in the short run India stood to benefit from the inclusion in the Index. However, whether India would have been able to sustain the momentum in the long run hinged on its economic performance.

This article was originally published in Financial Express.

Link to the article: https://www.financialexpress.com/market/did-indian-debt-markets-miss-a-game-changer-opportunity-again/2758115/